will long term capital gains tax change in 2021

Could capital gains taxes increase in 2021. Signed 5 August 1997.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Then there is timing.

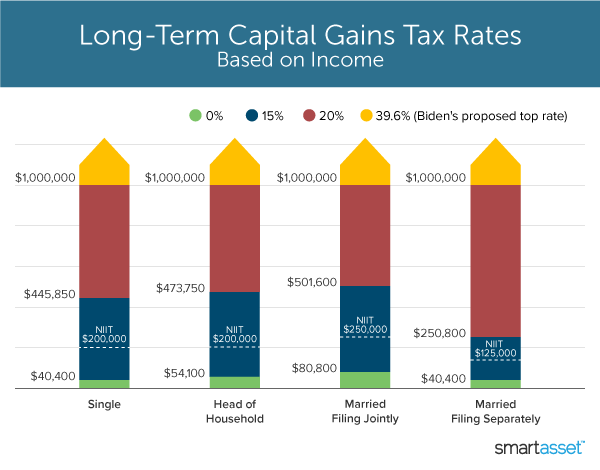

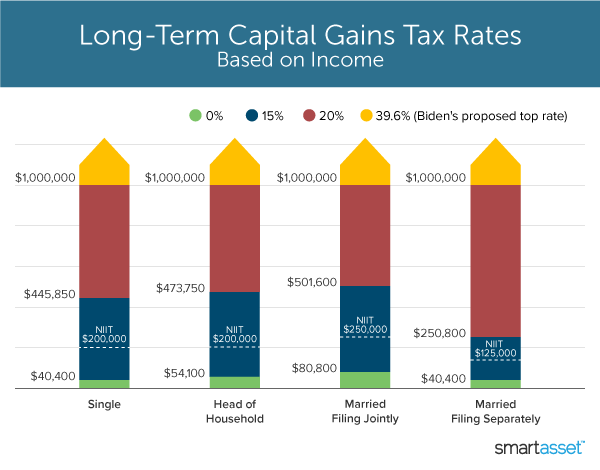

. As you can see the rate is based on your taxable income and how you file your income taxes. The top rate would be 288. Investors who are unsure whether their investment account is subject to capital gains tax can.

An Administration proposal would double the top tax rate from 20 to 396 on long-term capital gains and qualified dividends. Long-term capital gains taxes are assessed if you sell investments at a profit after owning them for more than a year. Aside from annual inflation adjustments there arent any significant capital gains tax changes on tap for 2021.

The IRS adjusts the income thresholds for capital gains tax rates every year for inflation. It can be worth it to consider waiting. The Adoption Credit also increased.

That applies to both long- and short-term capital gains. Hawaiis capital gains tax rate is 725. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Note however that proposal also calls for an increase in ordinary income rates to a top rate of 396. The The Lifetime Learning Credit is worth up to 2000 and there is no limit on the number of years the credit can be claimed.

While the way capital gains taxes are treated may change in 2021 those who had previously been in either the 0 or 15 categories will likely see no change. This rate is typically lower than the ordinary income tax rate. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987.

Long-term capital gains are taxed at either 0 15 or 20 depending on your tax bracket. You can compare the 2020 and 2021 tax rates for long-term capital gains. Heres a breakdown of where long-term capital gains tax rates sit in 2020.

On the capital gains side the idea is. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

As a reminder the proposal calls for taxing long-term capital gains at ordinary income rates for high-income individuals and trusts 408 being the highest capital gains rate with a 37 income tax rate and the 38 net investment income tax. To take the capital gains top rate to 25 for people earning more than 400000 per year and making. Long-term gains still get taxed at rates of 0 15 or 20 depending on the.

That applies to both long- and short-term capital gains. President Joe Biden recently announced his individual tax proposals which include a 396 long-term capital gains tax rate the elimination of the stepped-up basis on. Long-term capital gains are taxed at their own long-term capital gains rates which are less than most ordinary tax rates.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Of course not every capital asset is sold at a profit. Some other types of assets might be taxed at a higher rate.

Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed. These numbers generally change from year to year. Long Term Capital Gains Tax Rates If you have held an asset for more.

The TCJA created unique tax brackets for long-term capital gains tax. Here are the 2021 long-term capital gains tax rates. Tax Rates for Long-Term Capital Gains 2021.

These gains are taxed as per the ordinary income tax rate 10 12 22 24 32 35 or 37. That brings their total capital gains tax up to 408 in 2021 and 434 in 2021 from 20 currently. For example UBS expects lawmakers to pass a 28 long-term capital gains tax rate instead of 396.

Long-term capital gainstaxes are assessed if you sell investments. One crucial change for the tax year 2021 and beyond is that you can claim the EITC as long as your investment income. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest.

Remember if you have short-term capital gains they are taxed at the ordinary income tax rates. The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income. There is currently a bill that if passed would increase the.

This resulted in a 60 increase in the capital. Assets held for a year or less are considered short-term capital gains while assets held for longer than a year are long-term capital gains. Biden proposed making the capital gains tax changes retroactive to April 2021 in order to.

May 11 2021 800 AM EDT. In the case of long-term capital gains you are taxed at rates of 0 15 or 20 depending on your income and filing status. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20.

What You Need To Know About Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What You Need To Know About Capital Gains Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Tax What Is It When Do You Pay It

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Selling Stock How Capital Gains Are Taxed The Motley Fool

What You Need To Know About Capital Gains Tax

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)